Beauty dealmaking in 2025 didn’t move in a straight line, but it did close the year with more discipline than expected. In Q4, the BeautyMatter Deal Index tracked 77 transactions, down 20.2% from Q4 2024, making what is typically the industry’s most active quarter unusually subdued. But the softer finish wasn’t an outlier; it was consistent with the broader 2025 deal environment: less volume, more selectivity, and a market increasingly driven by conviction rather than momentum. Against a macro backdrop defined by tariff uncertainty, inflation fears, and ongoing questions around consumer demand, beauty continued to stand out as one of the most resilient segments of the consumer economy. And while headlines remained noisy, dealmaking persisted—measured, strategic, and focused on assets that could credibly deliver durable growth, defensible margin, and long-term category relevance.

Q4 2025 Deal Activity By the Numbers

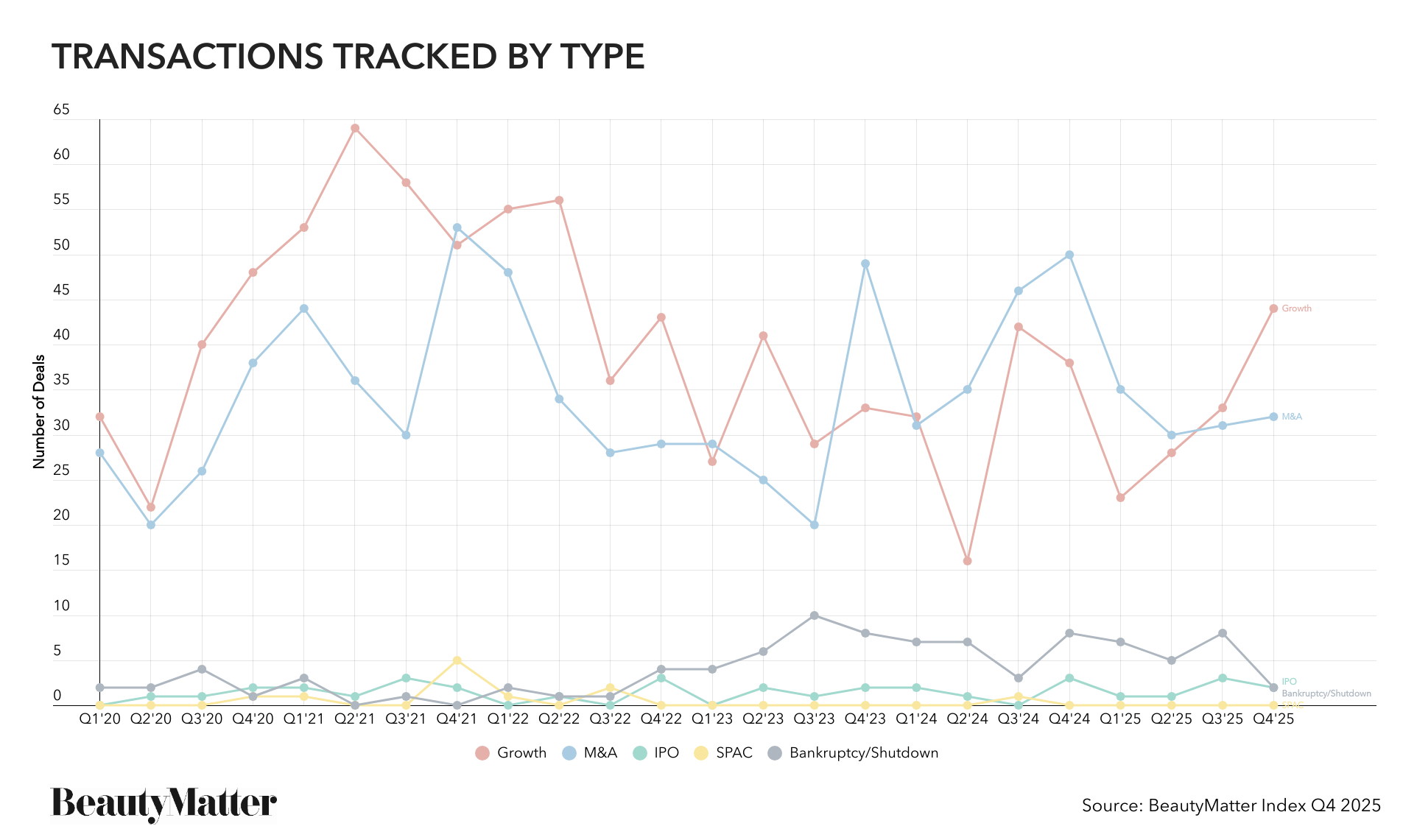

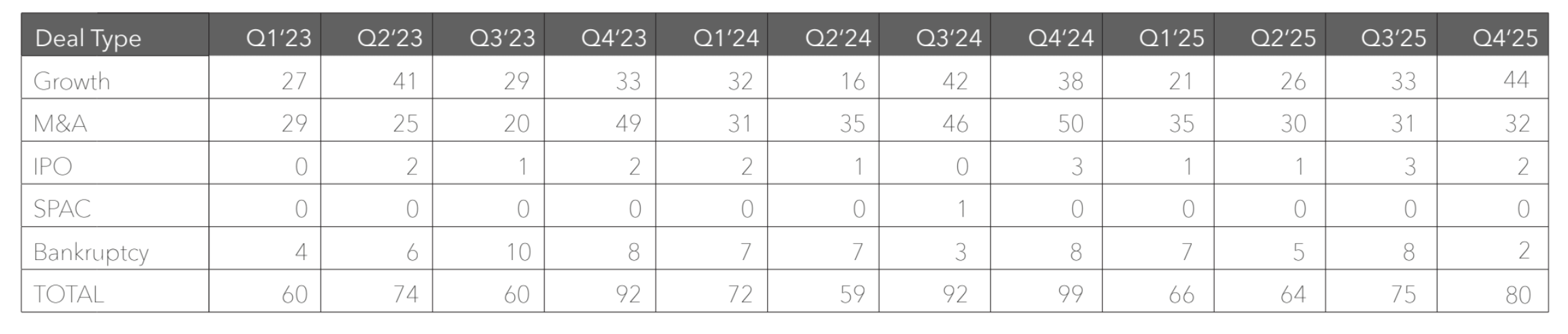

The BeautyMatter Deal Index tracked 77 transactions in Q4 2025, a 20.2% decline compared to Q4 2024. For the year, the Index tracked 262 deals, an 11.8% year-over-year decline. In Q4, the Index tracked 44 growth investments, an increase of 15.8% year over year, and 31 M&A transactions, a 38.0% decline. For the year, the Index tracked 128 growth investments, even with 2024, and 127 M&A transactions, a 21.6% decline.

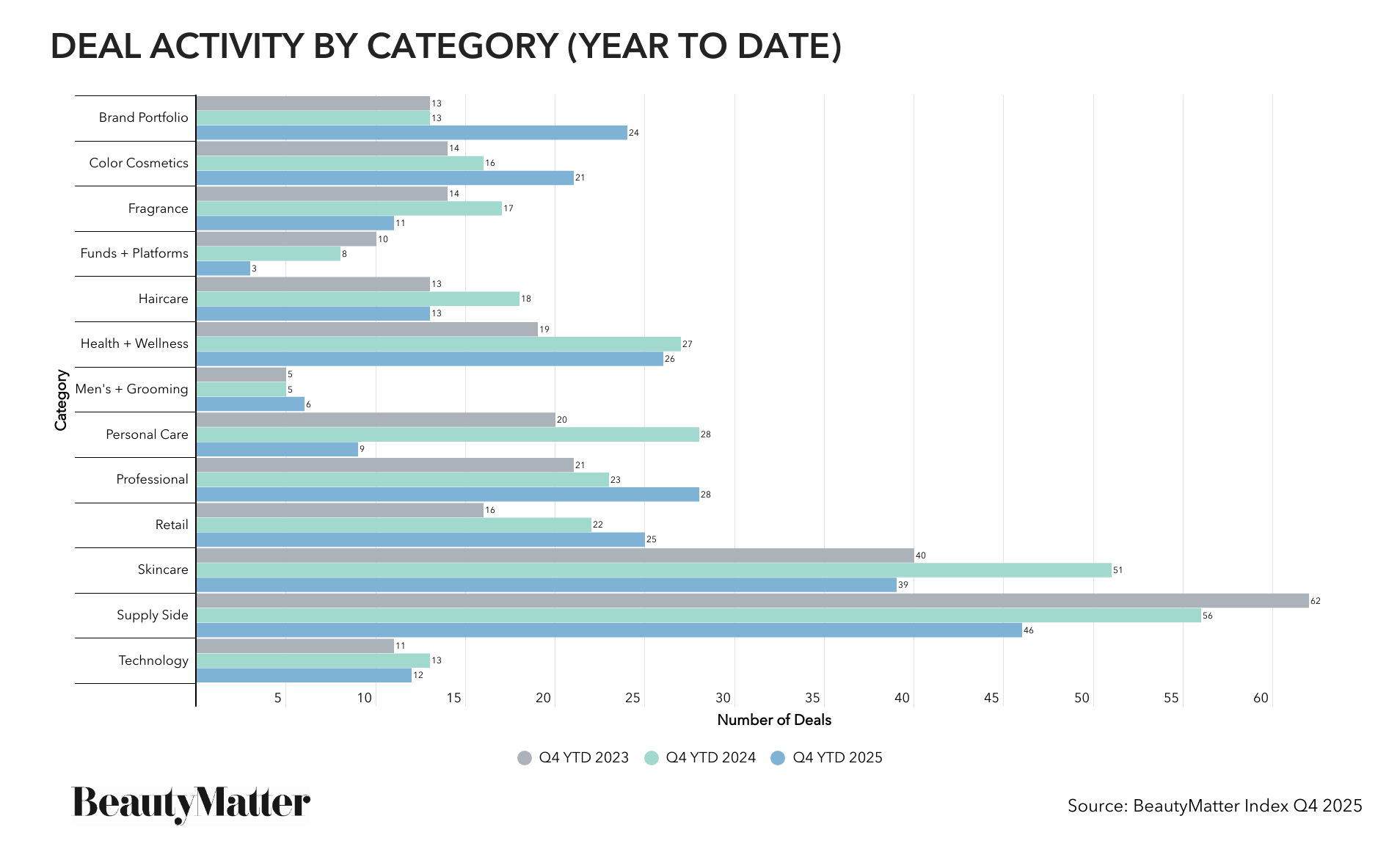

During the year, the top-performing categories in terms of deal activity were brand portfolio (up 84.6%), color cosmetics (up 31.3%), professional (up 21.7%), men’s + grooming (up 20.0%), and retail (up 13.6%). Category laggards included personal care (down 67.9%), funds + platforms (down 62.5%), fragrance (down 35.3%), haircare (down 27.8%), skincare (down 25.5%), supply side (down 17.9%), technology (down 7.7%), and health + wellness (down 3.7%).

Q4 2025 Deals to Know

Of the 77 deals tracked by the BeautyMatter Deal Index in Q4 2025, here are the deals people were talking about:

Category | Selected Deals

Brand Portfolio

Color Cosmetics

Fragrance

Funds + Platform

Haircare

Health + Wellness

Men’s + Grooming

Personal Care

Professional

Retail

Skincare

Supply Side

Technology

Brand Failures

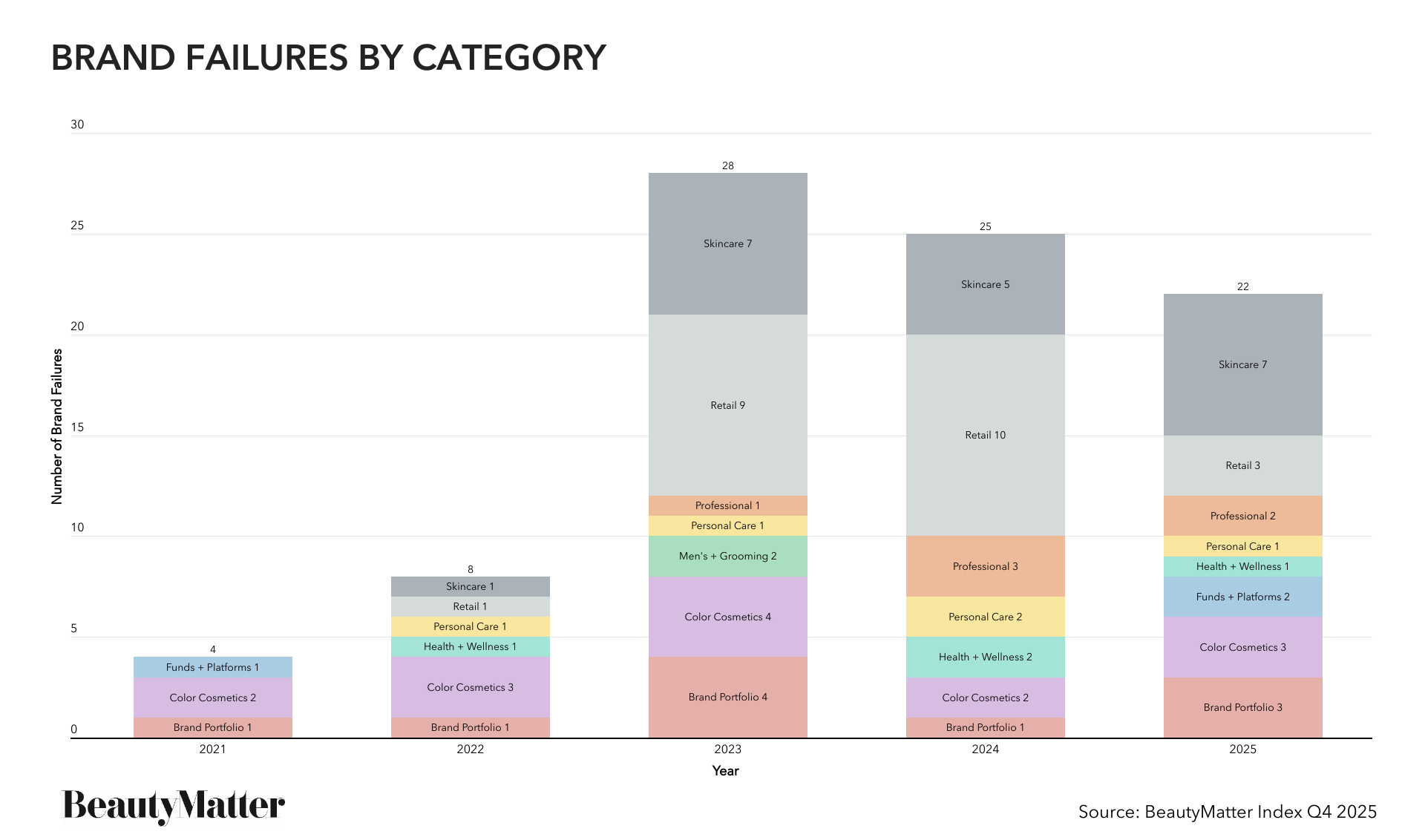

The Index also tracked two brand failures during the quarter (a combination of bankruptcies and shutdowns), including the bankruptcy of the brand portfolio Valley of the Sun Cosmetics, and German retailer Parfümerie Pieper.

For the year, the Index tracked a total of 22 brand failures in 2025. This compares with 25 in 2024 and 28 in 2023, evidence that the sector’s attrition rate has remained stubbornly consistent over the past three years, even as deal volume fluctuated. In other words, while beauty continues to outperform many consumer categories, it is not immune to structural pressure, and the market has become far less forgiving.

These failures reflect a convergence of challenges that are increasingly systemic rather than cyclical: faster-shifting consumer preferences, heightened shopper selectivity, and a cost environment that has reset expectations across everything from inventory to customer acquisition. Just as importantly, they underscore a capital market that has moved from growth at all costs to disciplined underwriting. In a highly selective funding environment, brands without clear differentiation, strong unit economics, and a credible path to profitability are finding that time—and liquidity—runs out quickly.

Q4’s Signal: The Market Didn’t Slow—It Got More Selective

Taken together, Q4 underscored the defining characteristic of the 2025 deal market: selectivity. Even with a meaningful year-over-year decline in M&A activity, growth capital remained active, suggesting investors are still willing to fund opportunity, but far more cautious about underwriting exits. The quarter’s most consequential transactions reinforced where conviction still exists: strategic portfolio moves, high-confidence category bets, and assets that offer either clear differentiation or structural advantage. In other words, the market did not shut down—it simply became more discriminating about what qualifies as “must own.”

The more important signal may be what didn’t happen. Q4 is typically when pent-up processes are clear, yet many brands and sponsors chose to wait rather than force outcomes in a choppy macro environment. That restraint speaks to a deal market that is increasingly bifurcated; premium assets continue to transact at strong valuations, while the middle remains crowded and difficult to price. Heading into 2026, the implication is clear: the bar for transactability has risen, and the winners will be those who can demonstrate not just growth, but a durable operating model—margin resilience, defensible demand, and a credible path to scale.